On April 6, 2022, following the consultation of industry stakeholders in the summer of 2021, the Canadian Insurance Services Regulatory Organizations (“CISRO”) published the Principles of Conduct for Insurance Intermediaries (the “Principles”) for the fair treatment of customers in the life and health, and property and casualty insurance markets in Canada.

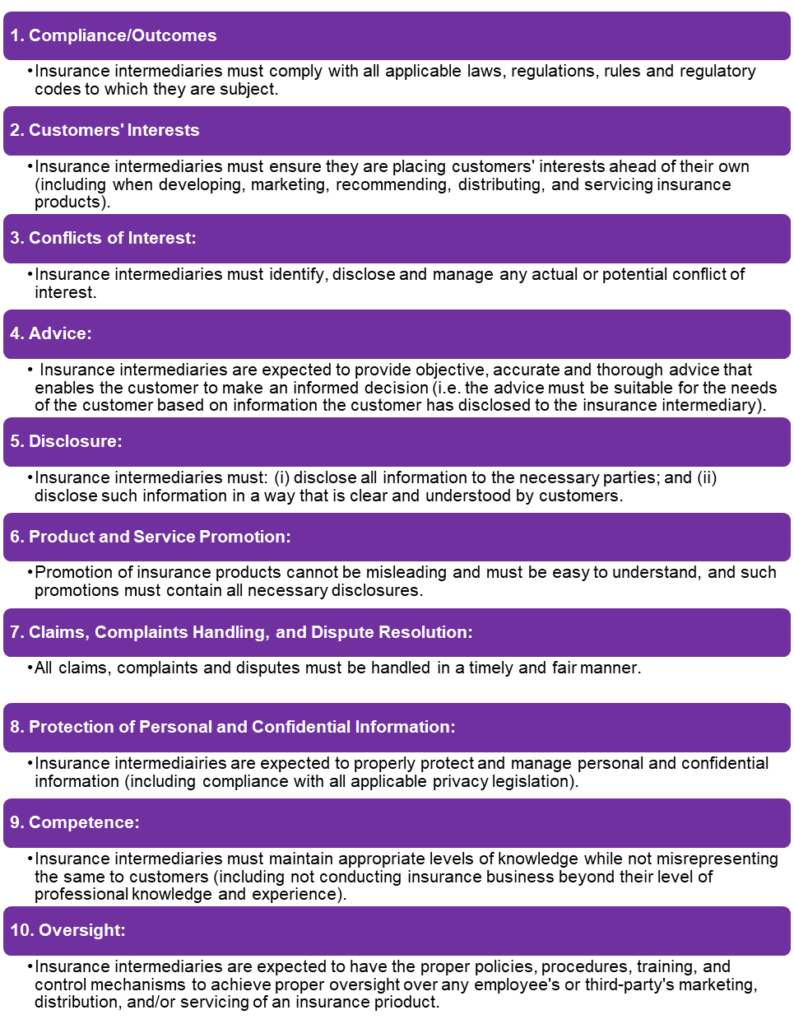

The Principles consist of ten professional behavior and conduct expectations for the fair treatment of customers by insurance intermediaries in Canada. It is important to note that the Principles define “insurance intermediary” and “customer” quite broadly. Specifically, the definition of “insurance intermediary” includes adjusters, agents, brokers, representatives, MGAs, and third-party administrators. This includes captive agents, holders of restricted agent/agency licenses, and persons exempted from licensing requirements who are involved in the incidental sale of insurance products. Further, the definition of “customer” includes both policyholders and potential policyholders, and other beneficiaries and claimants with respect to an insurance policy.

CISRO noted that the Principles are intended to supplement, complement and build upon the intermediary elements in the Guidance on the Conduct of Insurance Business and Fair Treatment of Customers, and that the Principles are meant to align with the Insurance Core Principles of the International Association of Insurance Supervisors.

This article provides a brief overview of the Principles and their implementation by insurance intermediaries conducting life, health, and/or property and casualty insurance business in Canada.

The Principles

CISRO points out that insurance intermediaries should conduct their business following the Principles that are relevant to their business, while ensuring compliance with all applicable laws, regulations, rules, or regulatory codes within the jurisdictions in which they conduct business.

Implications for Insurance Intermediaries Conducting Insurance Business in Canada

In a questions and answers document accompanying the release of the Principles, CISRO provided some further guidance on how the Principles may be applied by insurance intermediaries in their respective businesses. CISRO indicated that:

- Insurance intermediaries are encouraged to share and explain the Principles to its customers.

- Provincial/territorial insurance regulators may publicly endorse or release further communications about the implementation of the Principles in their respective jurisdictions. For example, the Financial Services Regulatory Authority of Ontario has commenced a consultation period to examine the adoption of the Principles.

- Insurance intermediaries should conduct their businesses following the Principles that are relevant to them, while ensuring compliance with all applicable laws, regulations, rules, or regulatory codes.

- Insurers and intermediaries with contractual or regulatory oversight obligations for insurance intermediaries should ensure that (i) the relevant Principles are included in applicable education/training materials; and that (ii) the insurance intermediaries’ internal policies, procedures, codes of conduct, and other relevant documentation align with the Principles.

Insurance intermediaries conducting any insurance business in Canada should carefully review their internal procedures, policies, and practices to ensure compliance with the Principles. Prior to introducing any new promotions or programs, insurance intermediaries should also consider the structure and details of such promotions or programs in light of the Principles, including whether the insurance intermediary has sufficient oversight over any relevant employees or third parties.

Dentons Canada’s Insurance Regulatory group would be pleased to assist in this regard.